About PiggyVest

PiggyVest is a savings and investment platform launched in 2016 and is primarily a savings app. Formerly known as Piggy Bank, they rebranded to become PiggyVest in 2019 and also began to offer investment opportunities to users besides savings.

It is a platform that wants to give everybody the power to manage and grow their finances better.

Table of contents

PiggyVest App

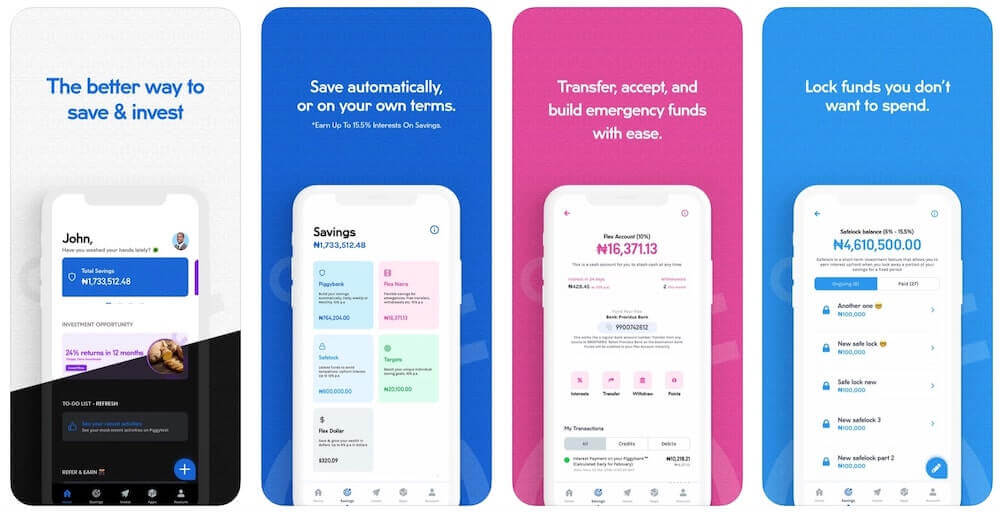

The PiggyVest app is available on both Android and iOS, and is very trust-worthy. It requires no deposit or monthly fees, and the interface of both the web and mobile applications are user-friendly. Saving with PiggyVest is not just safe and secure, but it also disciplines you by giving an option of locking your funds until designated release date.

How Many Products Does PiggyVest Have?

PiggyVest has a variety of products for investments and savings. The savings part has five features. They include: Piggybank, Safelock, Targets, Flex Naira, and Flex Dollar.

1. Piggybank

This is the core online savings aspect of PiggyVest. Here, you can save any amount of money at any point in time from your bank account. There is also an Autosave feature that automatically withdraws from your account daily, weekly, or monthly (according to each user’s preference). An interest of 10% is paid per annum on this feature.

2. Safelock

This allows you to set money aside for a fixed period. You are denied access to these funds until maturity. If you decide to Safelock a particular amount of money, the funds are locked until the time you choose. This feature of PiggyVest is particularly useful if you need to save money for future purposes. (For instance, school fees or a car). The cool thing about Safelock is that the interest rate of 6%-15% per annum will be paid upfront.

3. Targets

Just as the name implies, Targets helps you save towards particular goals like house rent, school fees, etc. It also encourages group savings where each member has a payment frequency daily, and each group has how much they expect to have at the date of maturity. This feature is beneficial as it helps people with similar interests save towards a common goal. The interest rate is 10% per annum.

4. Flex Naira

Flex Naira is a flexible savings wallet where interests earned on all other PiggyVest features are deposited. As a user, you can fund your Piggybank, Target, Safelock, Flex Dollar, or Investify using funds in your Flex. The rule here is that you can only withdraw once every ten hours, with a maximum of four withdrawals. Once you exceed this maximum, all accrued interest on Flex savings will be lost. The interest rate on this feature is 10% per annum.

5. Flex Dollar

Flex Dollar allows you to save, invest, as well as transfer your funds in dollars. The market behaviors determine the interest rates here.

How Do Investments Work on PiggyVest?

- Investify: Investify is the investment part of PiggyVest. It gives you the option of earning more on your savings by investing in primary and secondary investment opportunities. These investments have low or medium risks and are usually in agriculture, real estate, and transportation.

Interest Rates on PiggyVest

The different interest rates available on PiggyVest are:

- 10% per annum on Piggybank

- Up to 15.5% per annum on SafeLock

- 10% per annum on Target

- 10% per annum on Flex

- 6% per annum on Flex Dollar

- Up to 25% on Investify

Conclusion

In conclusion, PiggyVest helps you save and offers you the option of increasing the value of your savings. Piggyvest is the best bet for salary earners looking for how to save money from salary, freelancers, traders, students looking for how to save money and everyone looking to explore saving opportunities. It also mitigates risks associated with investment by carefully scrutinizing opportunities before making it available to its customers.

For a detailed comparison of two of the most popular savings and investment apps in Nigeria, we recommend you check out this post on Piggyvest vs Cowrywise.